What Is Yield Farming? DeFi Crypto Farming On Uniswap v3 Explained

Key Insights

- After Ethereum’s Dencun (EIP-4844) slashed rollup data costs so L2 swaps often cost only cents, it’s finally practical to harvest and compound frequently even with small balances, while Uniswap v3’s concentrated-liquidity design means blue-chip or stable-stable pools can turn steady volume into dependable fee APRs as long as you keep an eye on APR-vs-APY math and gas.

- Uniswap v4’s singleton architecture, hooks, and flash accounting cut pool-creation/routing gas and enable dynamic fees, auto-rebalancing, on-chain limit orders, and native ETH (especially valuable on L2s), yet every hook is its own smart contract, so read audits and permissions before depositing to hook-enabled pools.

- Process beats guesswork for LPs: match fee tiers to volatility, size your price range to balance fee density against range-out risk, stress-test impermanent loss before funding, and use simulators/back-tests or start small to validate your plan before you scale.

Introduction: What Is Yield Farming in DeFi?

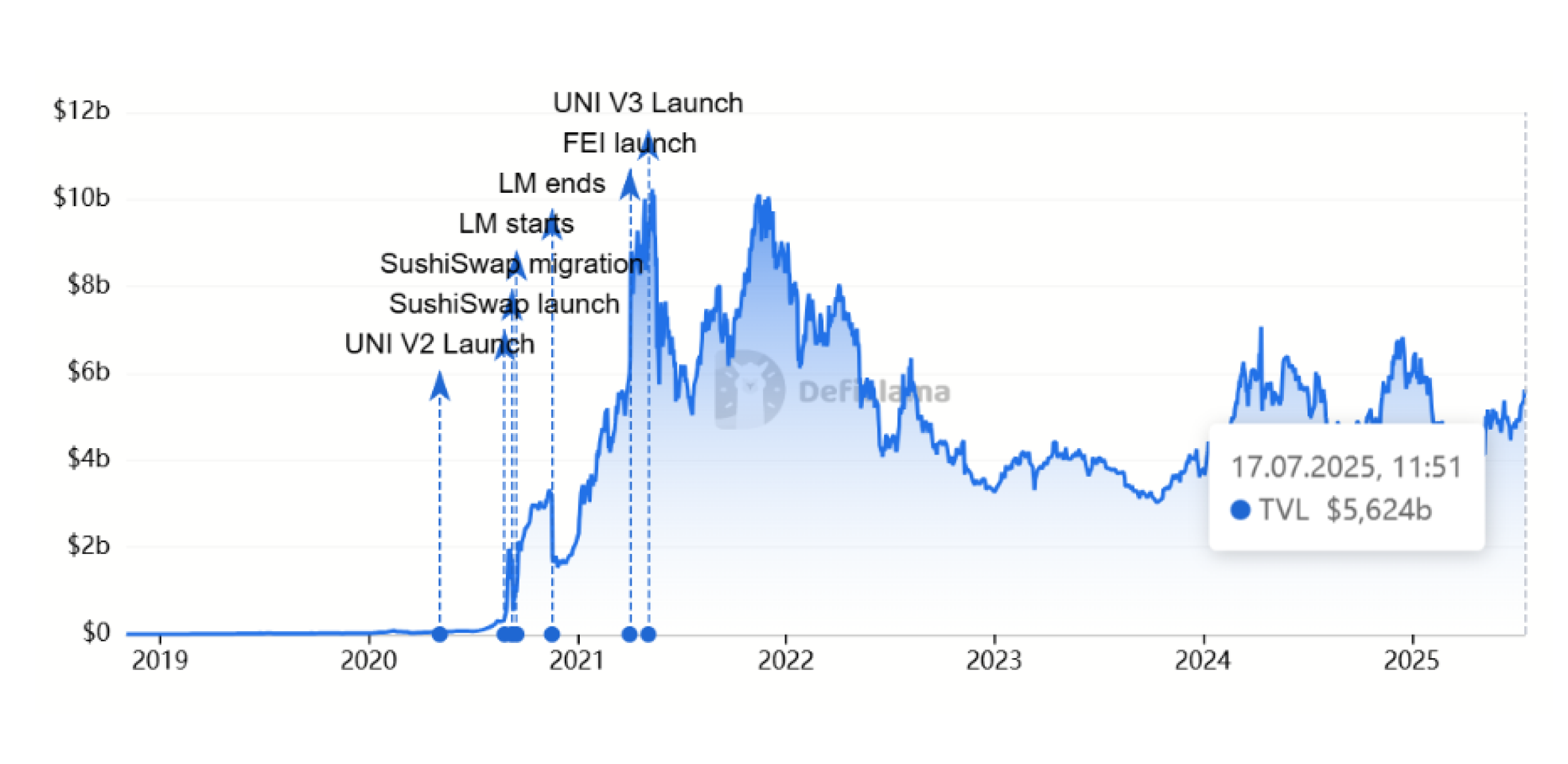

DeFi is having a moment again. Total value locked (TVL) across protocols recently hovered around a three-year high range, reflecting both rising crypto prices and renewed on-chain activity. SimpleSwap observes that the TVL resurgence is not just passive capital – more of it is actively seeking trading fees and incentives in automated market makers (AMMs) like Uniswap (more on the question of “What is Uniswap?” in the corresponding sections further).

Before we dive into strategy, here’s a quick primer – and why 2025’s fee compression on Layer-2 (L2) networks is a big unlock for everyday yield farmers.

What Is Yield Farming in Crypto Farming?

Yield farming (a.k.a. liquidity mining) lets token-holders deposit assets into DeFi protocols and earn rewards – primarily a share of swap fees and, in some pools, extra incentive tokens. In AMMs such as Uniswap, users add both sides of a pair (e.g., ETH and USDC) to a pool; traders pay fees on each swap, and those fees accrue to liquidity providers (LPs). That’s the core of DeFi yield farming.

SimpleSwap observes that fee-driven yield is distinct from token-emissions “inflation”: incentives may supplement returns, but the foundation is organic trading volume that produces real fee cash-flow for LPs. In 2025, with TVL back near cycle highs, the fee base is meaningful again – especially on L2s where transaction costs are now measured in cents.

Why Yield Farming and Uniswap Matter in 2025

Gas-saving upgrades (notably Ethereum’s Dencun/EIP-4844) slashed data costs for rollups, pushing average L2 swap fees to well under a dollar and, on some networks and times of day, into the low-cents range. That’s a structural tailwind for DeFi yield farming: it lowers the hurdle rate for re-ranging, claiming fees, and compounding. Uniswap v3sits at the center of this migration, with many high-volume pairs now thriving on L2s.

Yield Farming Fundamentals: How DeFi Yield Farming Works

To make smart choices, it helps to break down exactly where LP returns come from and what eats into them. Start with the mechanics, then layer in compounding, pool types, and risk.

How Yield Farming Rewards Are Generated

DeFi yield farming rewards come from three places:

Swap fees

Your pro-rata share of the pool’s fee revenue (e.g., 0.05%, 0.30%, or 1% on Uniswap v3) multiplied by traded volume. This is the bedrock of LP income.

Token emissions

Some pools offer extra tokens to bootstrap liquidity. These can juice returns temporarily but aren’t required for a pool to pay.

Price movements

Asset appreciation can lift the USD value of your position; conversely, price divergence can create impermanent loss (IL).

The main drag is gas: every deposit, withdrawal, fee claim, or re-range costs network fees. On L2s, those costs are far lower than L1 – often just cents – making active management viable at smaller scales. (SimpleSwap’s fee-tracker dashboard can help monitor these swings.) Importantly, not “all yield is inflation”: fee yield is earned from real trader activity, while emissions are optional sweeteners.

APY vs APR in Crypto Farming Returns

APR is simple interest; APY assumes reinvestment (compounding). Because LP fees are claimable repeatedly, many LPs compound weekly or even daily, pushing the effective APY higher than the quoted APR.

Example (30-day compounding): Suppose a position earns a 20% APR from fees. If you harvest and add fees back every 30 days, APY ≈ (1+0.20/12)12−1≈21.9%(1 + 0.20/12)^{12} - 1 ≈ 21.9\%. More frequent compounding increases APY further, net of gas.

Types of Pools & Tokens

Stable-stable (e.g., USDC/USDT): Lower volatility, steadier fees, minimal IL; ideal for conservative LPs.

Blue-chip majors (e.g., WETH/USDC): Higher volume and fees, with moderate IL.

Long-tail or volatile pairs: Potentially higher fee APRs but larger IL and liquidity risks. New or thin pools can be attractive in spurts but are less forgiving.

For new LPs, blue-chip pools typically provide the best mix of depth, analytics, and predictable behavior. Stable-stable pools are a close second for small accounts learning the ropes.

How Do You Calculate Yield Farming Returns?

Numbers beat intuition. This section decomposes return drivers, gives approachable formulas, and walks through a live-style Uniswap v3 example on ETH/USDC.

Components of Return

Swap-fee share

Your Share=Your LiquidityPool Liquidity\text{Your Share} = \frac{\text{Your Liquidity}}{\text{Pool Liquidity}}; fees earned = share × (pool fees collected).

Liquidity incentives

Additional tokens emitted per unit of liquidity per time.

Price appreciation minus impermanent loss

If prices diverge, IL reduces the value of LP holdings relative to HODL; fees may offset this.

Gas costs

Negative cash-flow for deposits, re-ranges, claims, and withdrawals – modeled at current median L2 fees to keep forecasts realistic. (See the SimpleSwap dashboard for live fee data.)

Key Formulas

APR vs APY:

APR=Fees Collected in PeriodCapital×1 yearperiod\text{APR} = \frac{\text{Fees Collected in Period}}{\text{Capital}}\times\frac{1\ \text{year}}{\text{period}}.

APY=(1+APRn)n−1\text{APY} = \left(1+\frac{\text{APR}}{n}\right)^n - 1 (with nn compounding intervals/year).ROI over horizon TT: ROIT=Ending Value−Starting ValueStarting Value\text{ROI}_T = \frac{\text{Ending Value} - \text{Starting Value}}{\text{Starting Value}}.

Constant-product AMM (pricing intuition): x⋅y=kx \cdot y = k.

Impermanent loss (full-range approximation):

Δ=2p1+p−1\Delta = \frac{2\sqrt{p}}{1+p} - 1

where pp is the price change ratio.

These get you close enough to stress-test a plan without drowning in calculus.

Step-by-Step Example Calculation

Scenario: $2,000 in an ETH/USDC Uniswap-v3 0.05% position. Suppose the pool’s recent TVL is in the tens of millions and daily volume likewise sizable. Pool fees at 0.05% equal volume × 0.0005. If your share of liquidity is small (e.g., $2,000 divided by pool TVL), daily fees will be proportional. Annualizing naïvely gives an indicative APR – before gas and price effects.

IL stress: If ETH rises +20% relative to USDC and you used a full-range-like band (for intuition), IL ≈ 21.2/(1+1.2)−1≈−0.41%2\sqrt{1.2}/(1+1.2) - 1 \approx -0.41\%. Narrower v3 ranges magnify both fee capture and IL sensitivity, so range choice matters. For a forward-looking estimate, many LPs plug these inputs into simulators to get fee projections by range width and to overlay IL paths.

Tools & Calculators

Metacrypt Uniswap v3 Calculator/Simulator – estimate fees/APR by pair, tier, and range.

Poolfish – simulate fees, APY/APR, and IL; supports multiple v3-style DEXes.

EatTheBlocks (tutorial) – approachable walkthrough of adding liquidity and reading returns.

SimpleSwap’s API integrations surface these sources inside our dashboard so you can model before you deposit. Test before you deposit remains the golden rule.

Practical Tips for Accurate Forecasts

SimpleSwap suggests: (1) Update volume assumptions weekly; volume regimes shift fast. (2) Model gas at current median L2 fees to avoid over-optimistic APY math. (3) Run IL stress tests at ±25% price moves across your chosen range(s) to see break-even fee levels.

What Is Uniswap v3 Protocol and Why It Changed DeFi Yield Farming

Uniswap v3 introduced concentrated liquidity, multiple fee tiers, and more precise price-range control. Those mechanics turned “dump-it-all-in” LPing into a strategy game with real levers. To ground this section, we’ll begin by incorporating a complete overview of Uniswap itself.

What Is Uniswap?

Uniswap is a decentralized exchange (DEX) that operates on an automated market maker (AMM) model. This means that users trade with each other using the liquidity that other participants add to pools.

In exchange for providing liquidity, such users receive a share of the fees from all trades that pass through the pool, which makes Uniswap one of the popular passive income tools in DeFi.

As of today there are three versions of the protocol, but two are actively used:

Uniswap V3 introduced the concept of concentrated liquidity, where providers can specify a price range in which their position operates. This made the protocol more efficient.

Uniswap V4, launched on January 31, 2025, brought innovations such as hooks, unified pools and reduced fees thanks to the singleton architecture and flash accounting. V4 already runs on the main EVM networks (Ethereum, Arbitrum, Base, etc.)

Uniswap became the first decentralized exchange to achieve mass adoption. The protocol was initially designed for the Ethereum blockchain, but today it supports dozens of EVM-compatible networks. It still holds a leading position in the DeFi segment and ranks in the top 10 protocols by TVL, which stands at $5.624 billion (according to DefiLlama as of July 2025).

Concentrated Liquidity in Uniswap v3

In v3, LPs choose a price range for their liquidity. When trades happen inside that band, your capital participates and earns fees; outside it, you earn nothing until you re-range. This design can deliver very high capital efficiency relative to v2 because liquidity isn’t sprayed from $0 to ∞ – it’s stacked where trading happens. Think of it like a range-bar graphic: the narrower the bar (within reason), the more “leveraged” your fee capture (and the more sensitive you are to price drifting out).

Capital Efficiency vs v2

Back-tests and research show that non-rebalancing v3 positions (full-range or stable-range) can outperform v2 on fee returns by a wide margin (with variation by tier/pair). In short: more fees per dollar deployed. That said, v3 shifts more responsibility to LPs to monitor ranges and rebalance when the market moves.

Multiple Fee Tiers

Uniswap v3 offers 0.01% (for tight-pegged stables), 0.05%, 0.30%, and 1% tiers so LPs can price risk appropriately. Volatile-asset pairs often perform best in 1% or 0.30% pools, whereas stables prefer 0.01%/0.05%. Your choice balances trade frequency, typical trade size, and expected volatility.

Uniswap v3 vs v4: What Uniswap’s Upgrade Means for Yield Farmers

Uniswap v4 introduces a singleton architecture that dramatically reduces pool-creation gas and hooks – modular smart-contract “plugins” enabling dynamic fees, auto-rebalancing, native ETH support, and more. For LPs, that can translate into higher net APY via lower overhead and smarter fee capture. Core differences:

Singleton pools: one contract for all pools → lower deployment and routing gas.

Hooks: programmable pool behavior (e.g., dynamic fees, TWAP guards, auto-compounders).

Flash accounting & native ETH: fewer wrapped-asset penalties and cheaper multi-hop routes.

Note: While v4 is launched and audited at the core level, individual hooks vary in quality; treat new hook-enabled pools as smart-contract risk until audits mature.

Risks of Yield Farming

Yield farming isn’t risk-free. Managing IL, range-out, and gas distinguishes a professional LP from a hopeful one.

Impermanent Loss Deep-Dive

IL occurs when the relative prices of pooled assets diverge. Using the full-range formula Δ=2p/(1+p)−1\Delta = 2\sqrt{p}/(1+p) - 1:

p = 1.2 (20% move) ⇒ IL ≈ –0.41%

p = 2.0 (100% move) ⇒ IL ≈ –5.7%

Fees earned while in-range may offset IL; that’s why volume and fee tier selection matter. With v3, narrow ranges boost fee density but also increase IL sensitivity; combining a fee-rich range with disciplined re-ranges (and, for advanced users, hedges) is key. Use an IL calculator before funding a pool.

Volatility & Range-Out Risk

If price exits your range, your position stops earning until you re-range. A practical cadence: daily checks for volatile majors or news-driven weeks; weekly for stable-stable or low-beta pairs. Consider keeping a small buffer (slightly wider ranges) if you can’t monitor daily.

Gas Fees & Layer-2 Solutions

L2s like Optimism, Arbitrum, Base, and others typically reduce swap costs by an order of magnitude or more relative to mainnet (often 10–20×+, depending on congestion). For smaller portfolios, that makes active LP management viable.

Advanced Tools & Automation for DeFi Yield Farming

Once you’ve nailed the basics, tools can help automate rebalancing, back-test ideas, and even stack yields with restaking – while adding new risks to weigh.

Rebalancing Vaults (Gamma, etc.)

Vault managers such as Gamma run strategies that auto-compound fees and adjust ranges for you, charging a small performance/management fee. Pros: hands-off operations, institutional-grade tactics, compounding of collected fees, and audit transparency. Cons: additional contract risk, strategy drift vs your risk appetite, and ongoing fees that reduce net APR.

Pros

• Automation (fewer transactions, time saved)

• Smart range management for volatile markets

• Often audited and widely usedCons

• Added smart-contract/platform risk

• Fees on top of pool fees

• Black-box strategy choices at times

Always read audits and disclosures before depositing.

Back-Testing Dashboards

Historical-tick simulators and dashboards let you replay past markets to assess robustness. Community and research tools (including LP simulation case studies and Dune dashboards for Uniswap v3 pool flows) help pressure-test range widths and rebalancing rules before live capital. At minimum, back-test a 6–12-month window covering both trending and choppy markets.

Restaking & Layer-2 Aggregators

Some LPs pair L2 yield farming with restaking (e.g., EigenLayer-based strategies) or L2 yield aggregators to stack rewards. That can raise headline APY but introduces additional smart-contract and protocol risks (restaking contracts, hooks, bridges). Treat these as experimental and conduct deep due diligence before allocating.

Market Trends & Future Outlook for Crypto Yield Farming and Uniswap

The next phase of DeFi yield farming is being shaped by cheaper blockspace, clearer (if imperfect) regulation, and new asset classes.

L2 Adoption & Fee Compression

Post-Dencun, L2s achieved dramatic fee compression. Median gas on several rollups fell to fractions of a cent at times, and token-swap costs frequently landed in the low-cents to sub-$0.30 range. For LPs, that means more frequent re-ranges and compounding without killing returns on fees. Expect continued L2-first liquidity growth through 2025.

Regulatory Signals

In the EU, MiCA is rolling out with disclosures and authorization standards for crypto-asset service providers. In the U.S., 2025 brought additional SEC disclosure guidance (not fee caps) for crypto products. Net effect: LP fees remain untouched, but transparency and disclosures are rising. Tone remains neutral-to-cautious – and evolving.

Cross-Chain Liquidity & RWAs

Omni-chain routing and bridges are making it simpler for liquidity to follow volume, while tokenized T-bill and other RWA pools continue to grow. That adds a class of “real-yield” primitives to pair against. SimpleSwap is actively exploring bridge integrations that preserve LP fee capture while minimizing additional risk.

Uniswap v3 Yield Farming Walk-Through: Step-by-Step Crypto Farming

Preparing Assets

To add liquidity and start earning on Uniswap, you need to prepare the assets that will participate in the pool. For example, you chose the ETH/USDC pool. To do this:

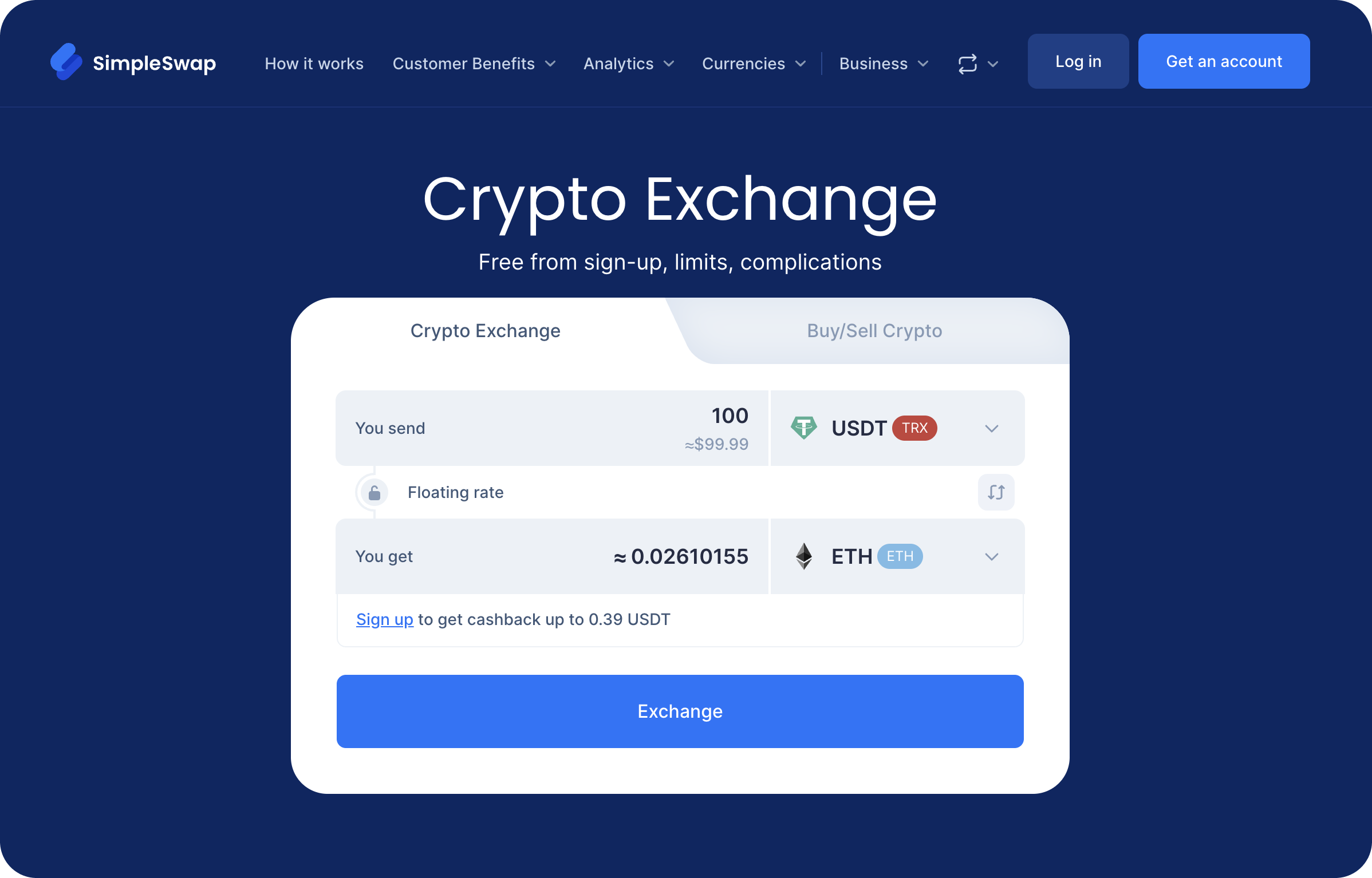

Go to SimpleSwap.io

Exchange your assets for ETH and USDC

Make sure the assets have arrived in your wallet

Note: Uniswap operates on multiple networks, and you need to obtain tokens in the network where you plan to add liquidity.

How Pools Work

Each pool on Uniswap is a reserve of two tokens (for example, ETH and USDC). When users make a swap, the protocol charges a fee (for example, 0.3%) and distributes it among liquidity providers whose positions are within the active range.

Yield depends on the width of the range: the narrower it is, the higher the profit – but also the higher the risk that your position becomes inactive if price exits the range.

Connecting a Wallet to Uniswap

Go to Uniswap and click Connect Wallet in the upper-right corner.

When you click Connect Wallet, the platform will prompt you to download or connect the Uniswap Wallet mobile wallet. This is a proprietary mobile wallet designed specifically for interacting with the protocol. It supports all Uniswap functions, fast authorization, and is optimized for the mobile interface.

The protocol also supports popular Web3 wallets such as MetaMask, Coinbase Wallet, Binance Wallet, and others, which open when you click Other wallets.

After connecting your wallet, make sure you have selected the network you need, for example, Ethereum or Arbitrum; this is important for working correctly with liquidity pools.

How to Add Liquidity on Uniswap V3

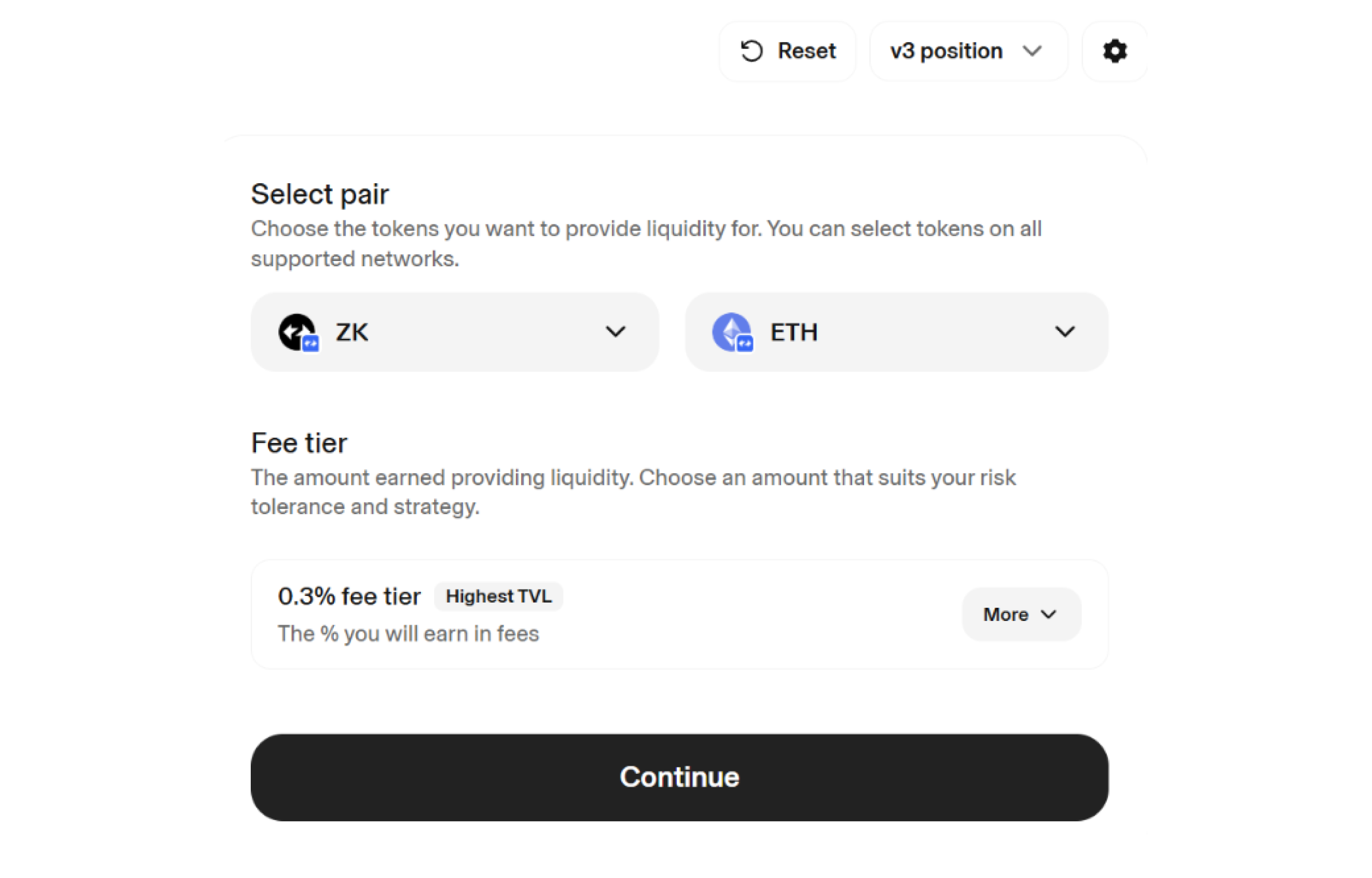

After connecting your wallet to Uniswap, go to the pool explorer. At the top of the screen, select the desired network (for example, Ethereum, Polygon, Arbitrum) and the version of the protocol; for the example below, we use V3.

Select the token pair you are interested in. Before choosing, check the pool’s liquidity volume: the more liquidity, the more stable the swaps and the lower the slippage. Click the one you need (for example, ZK/ETH to demonstrate the steps), then in the window that opens, select Add Liquidity.

After selecting the pair, you will proceed to the setup screen where the protocol will automatically set the fee. Several levels are usually available (for example, 0.05%, 0.3%, 1%), depending on the pair’s volatility. To continue, click Continue.

Note that above the pair selection you can also switch between versions of the protocol – V2, V3, and V4.

The next step is position setup, where Uniswap will prompt you to choose a price range. By default, Full Range is offered; your liquidity will be active at any price. This option suits passive investors but is less efficient for yield.

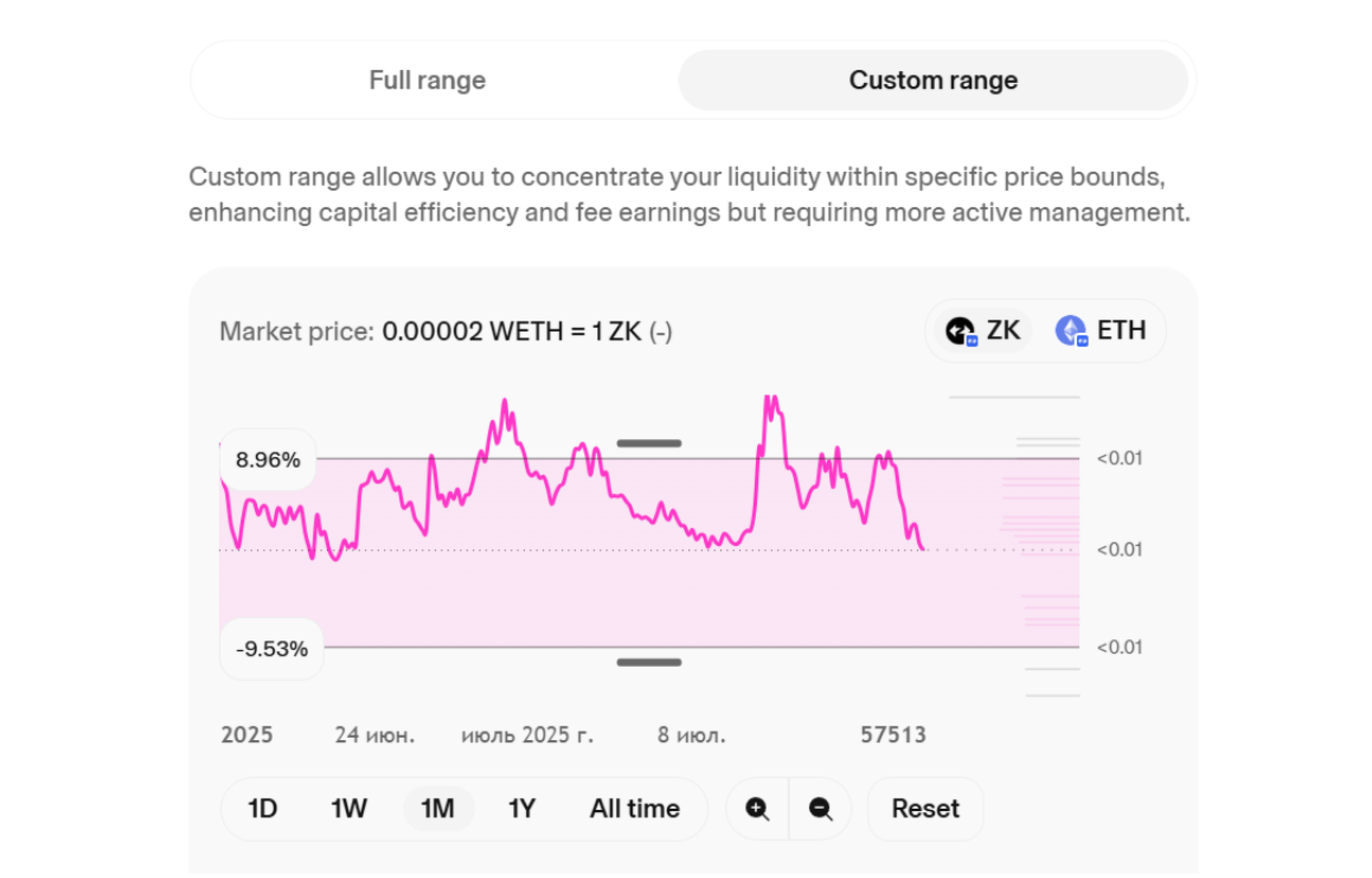

Switch to Custom and set your range manually.

The narrower the range, the higher the yield – but also the higher the risk that price will exit it.

When price exits the range:

Your liquidity becomes inactive

All your assets in the pool are automatically converted into the token toward which the price is moving. For example, if the price in the ETH/USDC pair rises, you will be left with USDC; if it falls, with ETH.

You stop earning fees until price returns to your range

Enter the amount of one of the tokens. The interface will automatically calculate how much of the second asset is needed to maintain proportions within the selected range.

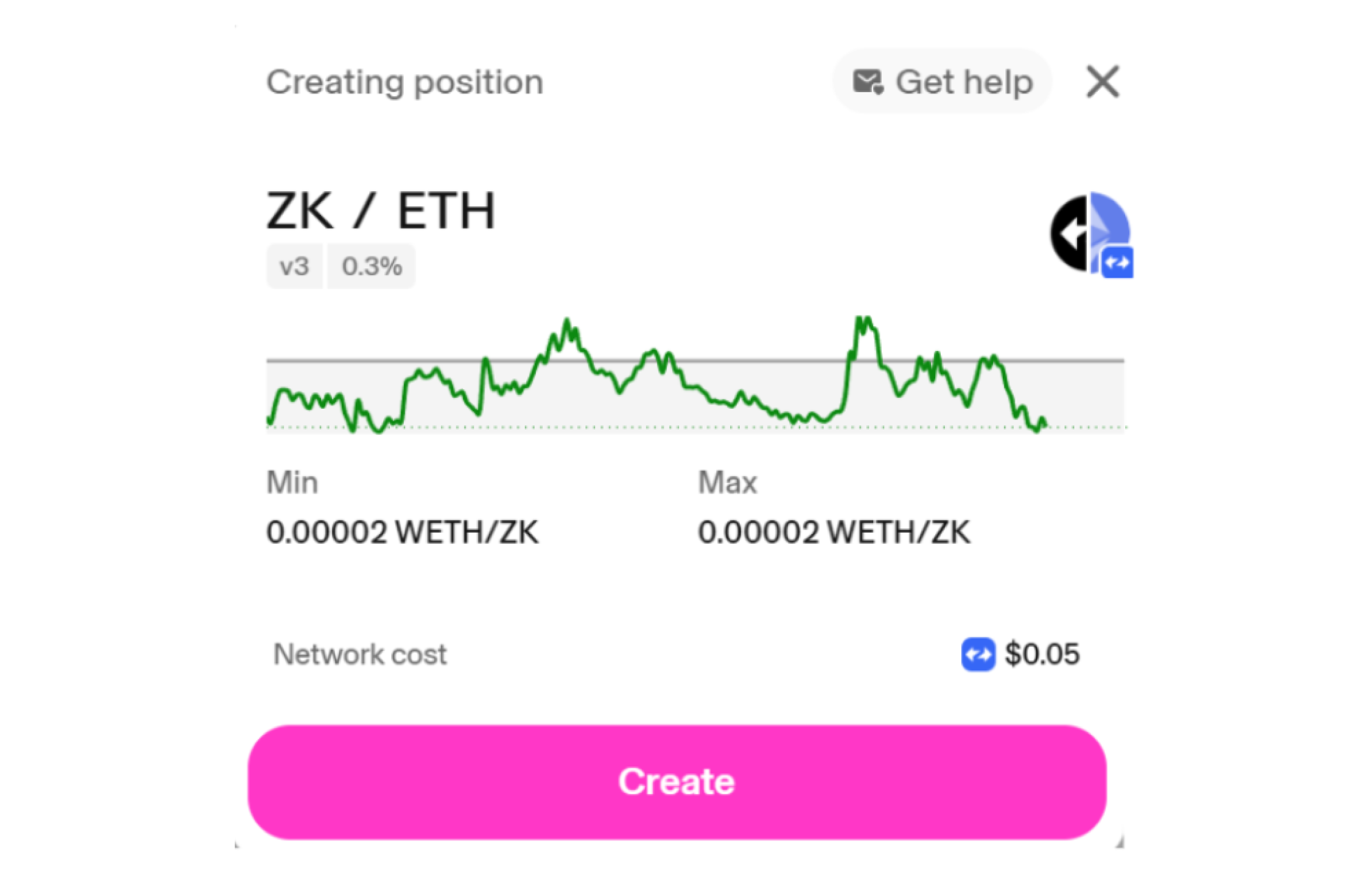

Next click Preview, then Create.

Confirm the transaction in your wallet. Done! You have become a liquidity provider in the selected pool and will now receive a share of fees from all swaps inside your range.

Impermanent Loss Risk

When providing liquidity, it is important to consider the risk of Impermanent Loss (IL) – temporary losses that occur when the price ratio in the pair changes. The stronger the deviation, the higher the IL. These losses can shrink or disappear if price returns to its initial level.

IL is minimal in low-volatility pairs (for example, USDC/DAI) and maximal in high-volatility pairs, such as ETH/memecoins.

What’s New in Uniswap v4?

Uniswap V4 is not yet as widely used as V3, but it offers more flexible settings for liquidity providers. Key innovations:

Hooks are smart-contract add-ons that allow you to program custom logic for pools (automatic rebalancing, limit orders, etc.)

Flash accounting reduces fees when adding or removing liquidity

Singleton architecture: all pools are located in a single smart contract, making the protocol cheaper and more compact

Support for native ETH, dynamic fees, and complex DeFi strategies

The choice between versions depends on your goals. V3 remains a convenient option for beginners and manual management. V4 suits experienced users building strategies and automation.

Conclusion

DeFi yield farming, at its best, is fee income from real trading activity, optionally boosted by incentives. In 2025, L2 fee compression plus Uniswap v3’s concentrated liquidity make it possible to pursue attractive passive income in crypto with smaller portfolios – provided you respect IL, monitor your ranges, and model gas. Uniswap v4’s singleton design and hooks promise further net-APY gains, but evaluate hook risk and audits before you dive in.

SimpleSwap observes that the strongest LPs combine: (1) pool selection discipline (blue-chip or stable-stable to start), (2) weekly volume refreshes, (3) gas-aware compounding, and (4) IL stress tests before each deposit. Ready to practice, then deploy? Discover liquidity-mining-ready pairs on SimpleSwap today – and use our dashboard to test assumptions before you click “Add Liquidity.”

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.